Let’s talk about something that can totally transform your finances: budget categories. Whether you’re new to budgeting or a seasoned pro, having the right categories in place is key to organizing your budget and making sure your money works for you.

In this ultimate guide, we’ll cover everything you need to know about budget categories — what to include, what to skip, and how to organize it all. By the end, you’ll have a crystal-clear plan for managing your money like a boss. Sounds good? Let’s dive in!

Table of Contents

Why Budget Categories Matter

We’ve seen how to set up a budget; here, we’ll see in more details how to establish budget categories that work for you. Before we jump into the details, let’s chat about why categories are so important.

- They Provide Clarity

Budget categories help you see exactly where your money is going. No more guessing or wondering why your bank account is empty at the end of the month! - They Help You Stay Organized

Dividing your expenses into categories makes it easier to track spending and stick to your budget. - They Show Your Priorities

Your budget reflects what matters most to you, and categories make those priorities crystal clear.

How to Organize a Budget

Organizing a budget can feel overwhelming at first but breaking it into categories makes it much easier. Here’s a simple process to follow:

- Start with Your Income

Begin by listing all your income sources, such as your salary, freelance work, side hustles, or rental income. - Break Down Your Expenses

Divide your expenses into broad categories like housing, transportation, food, and entertainment. - Set Spending Limits

Assign a specific dollar amount or percentage of your income to each category based on your priorities and financial goals. - Track and Adjust

Monitor your spending throughout the month and adjust your budget categories as needed.

Essential Budget Categories to Include

Let’s take a closer look at the most important categories you should include in your budget.

1. Housing

Your housing costs will likely be one of your biggest expenses. This category includes:

- Rent or mortgage payments

- Property taxes

- Homeowner’s or renter’s insurance

- Utilities (electricity, water, gas)

- Maintenance and repairs

💡 Tip: Try to keep your housing costs below 30% of your monthly income.

2. Transportation

Whether you drive, take public transit, or bike to work, transportation is an essential category. Include:

- Car payments

- Gas

- Insurance

- Maintenance and repairs

- Public transportation fares

- Parking fees

3. Food

We all have to eat, but it’s easy for food expenses to spiral out of control! Divide this category into:

- Groceries

- Dining out or takeout

- Coffee runs (if this is a regular habit!)

💡 Tip: Meal planning can help you stick to your grocery budget.

4. Savings and Investments

This category is for your future self! Allocate funds to:

- Emergency fund

- Retirement savings

- College savings (if applicable)

- Investments

💡 Goal: Aim to save at least 20% of your income if possible.

5. Debt Payments

If you’re paying off debt, create a dedicated category for:

- Credit card payments

- Student loans

- Car loans

- Personal loans

💡 Tip: Focus on paying off high-interest debt first to save money in the long run.

6. Health and Insurance

Taking care of your health is essential! Include:

- Health insurance premiums

- Co-pays and prescriptions

- Dental and vision care

7. Entertainment and Recreation

You deserve to have fun, so don’t forget to budget for things you enjoy, such as:

- Subscriptions (Netflix, Spotify, etc.)

- Hobbies (crafts, sports, etc.)

- Outings and vacations

💡 Tip: Be mindful of how much you spend here to avoid overspending on non-essentials.

8. Personal and Family Expenses

This category covers the day-to-day stuff that doesn’t fit anywhere else, like:

- Childcare

- Clothing and shoes

- Beauty and grooming (haircuts, skincare, etc.)

9. Giving and Donations

If giving back is important to you, create a category for:

- Charitable donations

- Tithing (if applicable)

- Gifts for birthdays, holidays, or special occasions

10. Miscellaneous

Finally, include a “miscellaneous” category for unexpected or one-off expenses. This can be a lifesaver when something random pops up!

What You Shouldn’t Include

Now, let’s talk about what NOT to include in your budget categories.

1. Overly Specific Categories

If your budget has too many tiny categories, it can become overwhelming to track. Instead, group similar expenses together (e.g., groceries and dining out under “Food”).

2. Unpredictable Income

If you have irregular income, base your budget on your lowest earning month. Don’t rely on potential income that isn’t guaranteed.

3. “Fun Money” That’s Too High

While it’s important to have fun, don’t let this category take over your budget. Balance is key!

Common Budget Mistakes to Avoid

Even with the best categories, budgeting mistakes can happen. Here’s how to avoid them:

- Not Accounting for Seasonal Expenses: Remember to budget for things like holiday gifts or back-to-school supplies.

- Forgetting Annual Expenses: Include things like car registration or insurance premiums.

- Underestimating Variable Expenses: It’s better to overestimate categories like groceries than to come up short.

How to Customize Your Budget Categories

Your budget should reflect YOUR life and priorities. Here are a few ways to customize your categories:

- Add Subcategories: For example, divide “Savings” into “Emergency Fund” and “Vacation Fund.”

- Use Percentages: Allocate a percentage of your income to each category (e.g., 10% for entertainment).

- Reevaluate Regularly: As your life changes, update your categories to reflect your new priorities.

Sample Budget Categories List

Here’s a quick recap of categories you can include in your budget:

- Housing

- Transportation

- Food

- Savings and Investments

- Debt Payments

- Health and Insurance

- Entertainment and Recreation

- Personal and Family Expenses

- Giving and Donations

- Miscellaneous

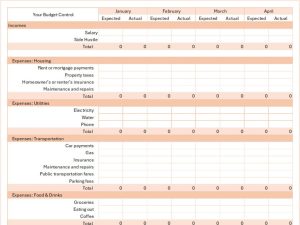

Do you want to see a sample of a budget template in real life? Check our free downloable monthly budget template – you can even use it as your budget spreadsheet. Just adjust the categories to suit you, and you’re good to go! 😉

How to use budget categories in practice

You might find that a mix of methods works best for you—like jotting down daily purchases in a notebook or on your phone so you don’t forget them, and then transferring everything to your spreadsheet once a week.

If that’s your style, keep things simple! Just write down what you bought and how much you spent in your quick notes, and save the category breakdown for when you organize everything in your spreadsheet later. That way, you stay on top of your spending without making budgeting feel like a full-time job! 😊

Final Thoughts

Having the right budget categories is a game-changer when it comes to managing your money. They help you stay organized, plan for the future, and make sure your spending aligns with your priorities.

Remember, your budget is personal — don’t be afraid to tweak these categories to fit your unique lifestyle and goals. And if something isn’t working, it’s okay to adjust!

What categories do you use in your budget? Let me know in the comments — I’d love to hear your ideas! Here’s to building a budget that works for you.