Hi friend! Are you ready to take control of your finances and get organized with your money? If the idea of budgeting makes you feel overwhelmed or if you’ve been searching for a system that actually works, I have great news for you: I’ve got a free printable monthly budget template that’s simple, easy to use, and super effective!

This template is designed to help you track your income, expenses, and savings, all in one place. Whether you’re a total beginner or a seasoned budgeter looking for a fresh start, this monthly budget worksheet will help you manage your finances with ease. Plus, it’s completely free to download! 🎉

Table of Contents

In this post, I’ll show you how to use the template, why budgeting is so important, and how it can help you achieve your financial goals. Let’s dive in!

Why You Need a Monthly Budget Template

If you’re not already budgeting, you might be wondering: Why is budgeting such a big deal? Here are a few reasons why creating a budget can totally transform your finances (and your stress levels):

1. Gain Clarity on Your Finances

When you write down your income and expenses, you know exactly where your money is going. No more wondering why your bank account is empty before payday!

2. Take Control of Your Spending

A budget helps you prioritize what’s important to you, whether that’s paying off debt, saving for a vacation, or simply covering your bills without stress.

3. Achieve Your Goals Faster

By planning your spending, you can set aside money for your big goals—like buying a house, building an emergency fund, or starting a business.

4. Reduce Financial Stress

Let’s face it—money can be a major source of stress. Budgeting gives you a clear plan, so you can stop worrying and start feeling confident about your finances.

What’s Included in the Free Budget Template

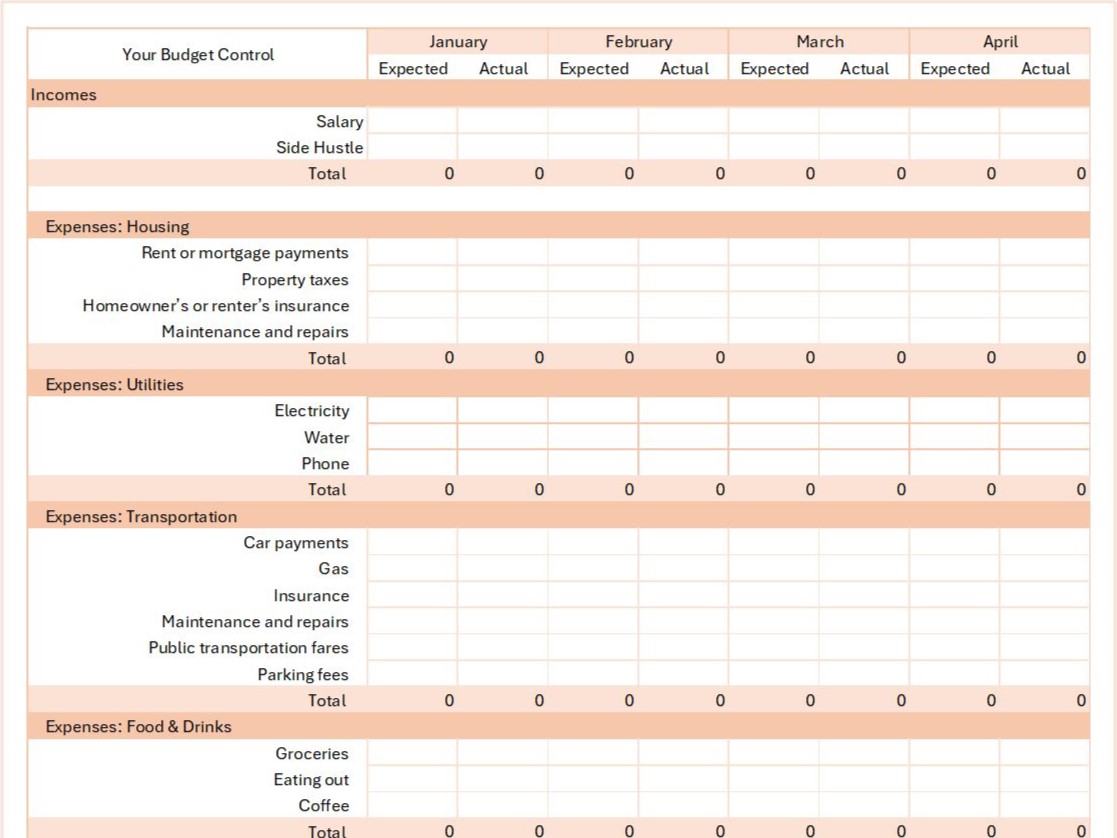

This free printable monthly budget template is designed to be super user-friendly and covers all the basics. Here’s what you’ll find:

1. Income Section

This is where you’ll list all your sources of income for the month—your paycheck, side hustle earnings, or any other money coming in.

2. Expense Categories

We’ve included space for all your major spending categories, like:

- Housing (rent/mortgage, maintenance)

- Transportation (gas, public transit)

- Food (groceries, dining out)

- Fun money (entertainment, hobbies)

You can add or remove categories and subcategories to customize the monthly budget template to your needs.

3. Totaling Sections

At the bottom, you’ll calculate:

- Total income

- Total expenses

4. Savings Section

Use this space to alocate your savings between your bank account, investments or wallet.

How to Use the Monthly Budget Worksheet

Step 1: Download the Template

Print it out or use it digitally if you prefer.It is saved as .xls, so you can use it on any Excel version.

Step 2: Adjust it to your needs

This template has space to fill your expected and actual budget for 4 months – January to April. You can edit the names of the month on the top of the chart to budget for May to August and September to December.

You can check the categories and subcategories included to add, change or remove lines as you see fit. The more personalized to you, the better your budget will be. 😉

💡 Pro Tip: The template is made so you can add your incomes and expenses and it sums and subtracts everything automatically on Excel. If you intend to print it, you may want to delete all the “zeros” in the template. Doing this lets you print a blank template, but removes the ability to calculate. Never mind, you can always download it again. 😉

Step 3: Fill in Your Expected Income

Start by listing all the money you expect to bring in this month. Be sure to include:

- Your regular paycheck

- Side hustle income

- Freelance or gig work

- Any other sources of income (like child support or gifts)

💡 Pro Tip: If your income varies, estimate on the lower side to avoid overspending.

Step 4: List Your Fixed Expenses

Fixed expenses are the bills that stay the same each month, like:

- Rent or mortgage

- Insurance premiums

- Loan payments

Add these to the appropriate categories in your budget, in the expected column.

Step 5: Add Variable Expenses

Next, list your variable expenses—things that can change month to month, like:

- Groceries

- Utilities

- Gas

💡 Pro Tip: Look at your bank statements to get an idea of how much you typically spend in each category.

Step 6: Fill the real life columns

As the month progesses, fill the columns that reflect your actual expenses and incomes. This will allow you to compare your expected budget vs reality, and show where your money is going.

Step 7: Total Everything Up

At the bottom of the worksheet, calculate your total income and expenses. If your expenses are higher than your income, look for areas to cut back. If you have money left over, consider putting it toward your savings or paying off debt.

Tips for Sticking to Your Budget

Creating a budget is one thing—sticking to it is another! Here are some tips to help you stay on track:

1. Track Your Spending

Use a notebook, app, or the notes section of the template to track every purchase you make. This will help you stay accountable.

2. Review Your Budget Weekly

Set aside time each week to check in with your budget. Adjust as needed to stay on track.

3. Build in Some Fun Money

Budgets shouldn’t feel restrictive! Include a small “fun money” category for treats, like a coffee date or a new book.

4. Celebrate Small Wins

Did you stick to your grocery budget this month? Save $50 more than last month? Celebrate those victories—they’ll keep you motivated!

Why a Printable Template Is So Helpful

I know there are tons of budgeting apps and fancy tools out there, but there’s something so satisfying about writing things down on paper. A printable template:

- Keeps things simple: No complicated software to learn.

- Is customizable: You can tweak it to fit your unique needs.

- Is visually motivating: Seeing your numbers written out can make your progress feel real!

What Makes This Template Unique?

There are plenty of budget templates out there, but this one is designed with YOU in mind. It’s:

- Beginner-Friendly: Perfect for anyone new to budgeting.

- Customizable: Add your own categories or adjust as needed.

- Pretty (and free!): Because who says budgeting can’t be fun?

Final Thoughts

Creating a budget doesn’t have to be overwhelming or boring. With the right tools—like this free printable monthly budget template—you can take control of your finances and start building the life you want.

So what are you waiting for? Download your free budget template now and start taking charge of your money today. Put in practice what you have learnt from how to set up a budget and from the guide to budget categories! Let me know in the comments how you’re using it— I can’t wait to hear about your budgeting wins!