I know “budgeting” might not sound like the most exciting topic in the world, but let me tell you – it can be life-changing. When you set up a budget you take control of your finances; you’re not just managing money – you’re creating peace of mind, reducing stress, and paving the way for the life you’ve always dreamed of. Sounds pretty amazing, right? Let’s dive in and get started!

Table of Contents

Why Setting Up a Budget is So Important

Before we jump into the nitty-gritty, let’s talk about why budgeting matters. Think of a budget as your financial GPS. It shows you where you are, where you want to go, and how to get there. Without a budget, it’s easy to overspend, fall into debt, or lose track of your financial goals. But with one? You can save for that dream vacation, pay off debt faster, or finally build up that emergency fund you’ve been thinking about.

Step 1: Know Your Reason to Set Up a Budget

First things first—figure out why you’re budgeting. Are you trying to save for something specific, like a family trip or a new car? Do you want to eliminate the stress of living paycheck to paycheck? Or maybe you’re planning for the future, like buying a home or retiring early?

Write down your “why” and keep it somewhere visible (I suggest the fridge door!) Trust me, on those days when you’re tempted to blow the budget, having that reminder can help keep you on track.

Step 2: Track Your Income

Next up, let’s figure out how much money you’ve got coming in. This includes:

- Your paycheck(s)

- Any side hustle income

- Child support, alimony, or other regular sources of income

If your income varies (hello, freelancers and gig workers!), take the average of your earnings over the past three to six months. Write this number down—it’s the starting point for your budget!

Step 3: List Your Expenses

Now it’s time to get real about your spending. Break your expenses into two categories:

- Fixed Expenses – These are bills that don’t change much from month to month, like rent/mortgage, utilities, insurance, and subscriptions.

- Variable Expenses – These are things that fluctuate, like groceries, gas, entertainment, and dining out.

Take a look at your bank statements from the past three months to get a clear picture of where your money is going. Be honest with yourself—this isn’t about judgment, it’s about clarity.

Step 4: Give Every Dollar a Job

This is where the magic happens! Using the total amount of income you calculated earlier, assign every single dollar to a category. The goal is to “spend” all your income on paper (or in an app) before you actually spend it in real life.

Here’s a basic example:

- Rent/Mortgage: $1,200

- Utilities: $150

- Groceries: $400

- Debt Payments: $300

- Savings: $200

- Fun Money: $100

Total: $2,350 (assuming that’s your income!)

This method is often called “zero-based budgeting,” and it’s a game changer. By giving every dollar a purpose, you’ll feel more in control of your money.

Step 5: Prioritize Your Goals

When you’re setting up your budget, make sure your goals align with your priorities. If paying off debt is at the top of your list, allocate extra funds toward that. If building an emergency fund is more urgent, focus on that instead.

It’s all about balance. You can still have some fun money or treat yourself, but make sure your financial goals get the attention they deserve.

Step 6: Use Tools to Make Budgeting Easier

Let’s be real—no one wants to spend hours crunching numbers every month. Luckily, there are so many tools that can make budgeting a breeze. Here are a few options to check out:

- Apps like YNAB (You Need a Budget) or Mint

- Spreadsheets (that you can do on Excel)

- Budget Sheets (the simplest one: a white paper on the fridge where you write your goals and spendings!)

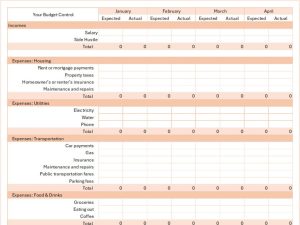

💡 Pro Tip: We have a printable monthly budget template spreadsheet for Excel that is free!!! It is also customizable, so you can make it work for you!

Choose the method that works best for you and your family. The easier it is, the more likely you are to stick with it. You can choose to start with the paper-on-the-fridge budget sheet and, once a week, transfer the data to an excel, where you can organize it all in different categories. As simple as it is, it can give a good insight of where the money is going.

Step 7: Track and Adjust

Here’s the thing about budgets—they’re not “set it and forget it.” Life happens, and your budget might need some tweaks along the way. For example:

- Your utility bill might spike in the winter.

- You might get a raise (yay!) or have an unexpected expense pop up.

Set aside 10–15 minutes once a week to review your budget and make any necessary adjustments. This habit will keep you on track and help you avoid surprises.

💡 Pro Tip: Don’t feel upset if your initial budget doesn’t exactly match reality. It is only natural that you will learn and get better at it with practice.

Step 8: Don’t Forget to Reward Yourself

Budgeting isn’t about deprivation — it’s about being intentional. So, celebrate your wins along the way! Maybe you treat yourself to a fancy coffee after paying off a credit card, or plan a family movie night after hitting a savings milestone. Rewards keep the process fun and motivating.

Common Budgeting Mistakes to Avoid

Nobody’s perfect, and it’s totally normal to hit a few bumps along the way. Here are some common mistakes to watch out for:

- Being too strict: Leave room for flexibility! Life doesn’t always go as planned.

- Not tracking small expenses: Little things like snacks or quick stops at the store can add up fast.

- Skipping the emergency fund: This is a biggie—always have some savings set aside for unexpected expenses.

Final Thoughts: You’ve Got This!

Setting up a budget might feel overwhelming at first, but I promise it’s worth it. It’s not just about the numbers—it’s about giving yourself freedom, peace of mind, and the ability to focus on what truly matters.

Start small, keep it simple, and don’t be afraid to make mistakes. You’re learning, growing, and taking charge of your finances, and that’s something to be proud of.

Got any questions or tips of your own on how to set up a budget? Drop them in the comments—I’d love to hear from you! Here’s to a brighter financial future!