Budget with Irregular Income – If you’re a freelancer, gig worker, or someone with an irregular income, you know how tricky it can be to create a budget. Some months your income might be amazing, while other months leave you wondering how you’ll make ends meet. Sound familiar?

The good news is that budgeting with irregular income doesn’t have to be overwhelming! With a little planning and the right tools, you can take control of your finances and feel confident, no matter what your paycheck looks like.

Table of Contents

Today, we’re diving into everything you need to know about how to budget with irregular income. Whether you’re a full-time freelancer, a side hustler, or working in the gig economy, these tips will help you create a budget that works for YOU.

Why Budgeting Is Crucial for Irregular Incomes

Let’s start with why budgeting is so important when your income fluctuates:

- It Reduces Stress: Knowing where your money is going (even on lower-income months) can bring you peace of mind.

- It Helps You Plan for the Future: With a budget, you can save for your goals, even if your income isn’t consistent.

- It Keeps You Prepared: A solid budget ensures you’re ready for unexpected expenses, slow months, or emergencies.

Challenges of Budgeting with Irregular Income

Before we dive into solutions, let’s talk about some of the unique challenges you might face:

- Inconsistent Paychecks: Your income can vary significantly from one month to the next.

- Unpredictable Expenses: Freelancers often have additional costs like taxes, business expenses, and health insurance.

- Difficulty Saving: It’s harder to save when your income fluctuates.

But don’t worry—these challenges aren’t impossible to overcome! Let’s break it down step by step.

Step 1: Find Your Baseline Income

When your income varies, it’s essential to know your bare minimum income—the lowest amount you expect to earn in a month.

💡 How to Calculate Your Baseline Income:

- Look at your income over the past 6–12 months.

- Identify the lowest amount you earned in a single month.

- Use this number as the baseline for your budget.

Step 2: Identify Your Fixed and Variable Expenses

Once you know your baseline income, figure out your expenses. These typically fall into two categories:

- Fixed Expenses: These don’t change month to month (e.g., rent/mortgage, utilities, car payments).

- Variable Expenses: These fluctuate (e.g., groceries, entertainment, travel).

💡 Pro Tip: List out all your expenses and prioritize the essentials like housing, food, and transportation.

Step 3: Build a Bare-Bones Budget

A bare-bones budget covers only the necessities, which is crucial during lower-income months.

Here’s an example:

- Rent: $1,200

- Groceries: $400

- Utilities: $200

- Transportation: $150

- Minimum Debt Payments: $200

Total: $2,150

Your bare-bones budget ensures you can cover your needs even during a slow month.

Step 4: Save During High-Income Months

When you have a great month and earn more than your baseline, don’t spend it all! Instead:

- Build an Emergency Fund: Save 3–6 months’ worth of living expenses to cover slow periods.

- Create a Buffer Fund: Set aside extra income to even out your paychecks during lower-income months.

💡 Pro Tips: Open a separate savings account for your buffer fund so you’re not tempted to dip into it. You can also apply the 80/20 budget rule to make sure you build your savings. 😉

Step 5: Automate Savings and Payments

Automation is a freelancer’s best friend!

- Set Up Automatic Transfers: Move a percentage of your income to savings every time you get paid.

- Automate Bill Payments: Avoid late fees by setting up automatic payments for your fixed expenses.

Step 6: Prepare for Taxes

One of the biggest budgeting mistakes freelancers make is forgetting about taxes. Unlike traditional employees, taxes aren’t withheld from your paycheck, so it’s up to you to set money aside.

💡 How to Plan for Taxes:

- Save 20–30% of your income for taxes.

- Open a separate account for tax savings.

- Pay estimated quarterly taxes to avoid penalties.

Step 7: Track Your Income and Expenses

Tracking your finances is even more important when your income fluctuates. Use tools like:

- Budgeting Apps: Mint, YNAB, or PocketGuard.

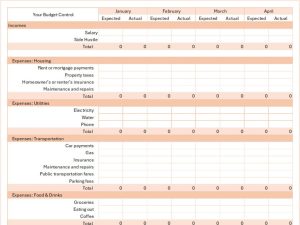

- Spreadsheets: Create a simple income and expense tracker.

- Old-School Notebook: If you prefer pen and paper, that works too!

The goal is to know exactly how much you’re earning, spending, and saving each month. Check our free printable monthly budget template – it is a good starting point to keep your finances on track!

Step 8: Adjust Your Budget Regularly

Your budget isn’t set in stone—it’s a living document that should adapt to your changing income. Review it monthly to:

- Adjust for high- or low-income months.

- Account for new expenses or changes in priorities.

💡 Pro Tip: Schedule a “money date” each month to check in with your budget.

Step 9: Diversify Your Income

One way to stabilize your finances as a freelancer or gig worker is to diversify your income streams. For example:

- Add a side hustle.

- Offer new services or products.

- Look for part-time or seasonal work during slow periods.

Having multiple income streams can help you avoid the rollercoaster of irregular paychecks.

Step 10: Don’t Forget Self-Care

Budgeting on an irregular income can feel stressful at times, so don’t forget to prioritize self-care. Give yourself grace, celebrate small wins, and take breaks when you need them.

Sample Budget for Freelancers

Here’s what an irregular income budget might look like for a freelancer earning $3,000 in one month:

- Savings and Buffer Fund: $600 (20%)

- Fixed Expenses: $1,500 (Rent, insurance, subscriptions)

- Variable Expenses: $500 (Groceries, transportation, entertainment)

- Taxes: $400

In higher-income months, you could increase your savings or pay down debt faster.

Final Thoughts

Budgeting with irregular income can be a challenge, but it’s absolutely doable with the right strategies. By building a bare-bones budget, saving during high-income months, and tracking your finances, you can take control of your money and feel confident, even when your paychecks fluctuate.

Remember, budgeting is a journey, not a destination. Be patient with yourself, make adjustments as needed, and don’t forget to celebrate your progress along the way.

What’s your biggest struggle with budgeting on an irregular income? Let me know in the comments—I’d love to help!