Let’s be real—budgeting can feel overwhelming sometimes. Between tracking every penny and trying to stick to strict spending categories, it’s easy to get frustrated and give up altogether. But what if I told you there’s a simpler way to manage your money?

Enter the 80/20 budget rule, a straightforward method that’s perfect for anyone who wants to simplify their finances without sacrificing their goals. In this post, we’ll break down exactly what the 80/20 budget rule is, how it works, and how you can start using it today.

Table of Contents

What Is the 80/20 Budget Rule?

The 80/20 budget rule is as simple as it sounds:

- 80% of your income is used for spending.

- 20% of your income is set aside for savings, investments and debt repayment.

Unlike other budgeting methods, this one doesn’t require you to track every single category in detail. Instead, it gives you a high-level framework to manage your money.

Why the 80/20 Budget Rule Works

Here’s why this method is a game-changer for so many people:

- It’s Simple to Follow

You don’t need to micromanage your spending. Just make sure you’re saving 20% and living within the remaining 80%. - It’s Flexible

Life isn’t one-size-fits-all, and neither is this budget. Whether you’re single, married, or raising a family, you can adapt the 80/20 rule to suit your lifestyle. - It Builds Healthy Habits

By prioritizing savings, you’re building a strong financial foundation without feeling deprived.

How to Start Using the 80/20 Budget Rule

Ready to give it a try? Here’s how to put the 80/20 budget rule into action.

1. Calculate Your Income

Start by figuring out your monthly take-home pay (your net income). This is the amount you have left after taxes, insurance, and other deductions.

💡 Tip: If your income varies month to month, use an average based on the last six months.

2. Allocate 20% for Savings and Debt Repayment

Take 20% of your income and use it for:

- Savings: This could include building an emergency fund, saving for a house, or investing for retirement.

- Debt Repayment: Focus on paying off high-interest debt like credit cards or personal loans.

💡 Example: If your monthly income is $4,000, you’d allocate $800 (20%) to savings and debt repayment.

3. Use the Remaining 80% for Spending

The remaining 80% of your income covers everything else:

- Rent or mortgage

- Groceries

- Utilities

- Transportation

- Entertainment

This is your “all-in” spending budget, so make sure you stay within this limit!

💡 Example: With a $4,000 income, you’d have $3,200 (80%) for your living expenses.

How to Stick to the 80/20 Budget Rule

Even with a simple method like this, it can be tricky to stick to your plan. Here are some tips to help you succeed:

1. Automate Your Savings

The easiest way to save is to make it automatic. Set up a direct deposit to transfer 20% of your paycheck into a separate savings account as soon as you get paid.

2. Track Your Spending (But Don’t Overcomplicate It)

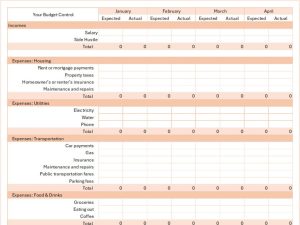

You don’t need a detailed spreadsheet—just keep an eye on your spending to make sure you’re staying within the 80% limit. A budgeting app like Mint or YNAB can make this super easy.

3. Adjust as Needed

The 80/20 rule is flexible, so don’t be afraid to tweak it if necessary. For example, if you’re aggressively paying off debt, you might allocate 30% to savings and debt repayment and live on 70%.

4. Build an Emergency Fund

Having an emergency fund (3–6 months of living expenses) gives you peace of mind and protects your budget from unexpected expenses.

5. Celebrate Progress

Saving 20% of your income is a big deal—don’t forget to celebrate your wins along the way! Treat yourself to something small or plan a budget-friendly outing when you hit milestones.

Pros and Cons of the 80/20 Budget Rule

Like any budgeting method, the 80/20 rule has its strengths and weaknesses. Let’s take a look:

Pros

- Easy to Implement: No need to track every penny or use complicated spreadsheets.

- Prioritizes Savings: Encourages you to save before spending.

- Flexible: Works for a variety of lifestyles and income levels.

Cons

- Lack of Detail: It doesn’t provide a breakdown for specific spending categories.

- May Not Work for High Debt: If you have significant debt, you might need to allocate more than 20% to repayments.

- Temptation to Overspend: Without strict categories, it’s easier to overspend in some areas.

Who Should Try the 80/20 Budget Rule?

The 80/20 rule is a great fit for:

- Beginners who want a simple, no-fuss budgeting method.

- Busy people who don’t have time for detailed expense tracking.

- Those with a steady income and manageable debt.

If you’re looking for a way to ease into budgeting without feeling overwhelmed, this method is definitely worth a try!

How the 80/20 Budget Rule Compares to Other Methods

Curious how it stacks up against other popular budgeting methods? Let’s compare:

80/20 vs. 50/30/20 Rule

- The 50/30/20 rule divides your income into needs (50%), wants (30%), and savings (20%).

- The 80/20 rule is simpler, combining needs and wants into one 80% category.

80/20 vs. Zero-Based Budgeting

- Zero-based budgeting assigns every dollar a job, requiring more detailed tracking.

- The 80/20 rule is less detailed, focusing on high-level allocations.

Real-Life Example of the 80/20 Budget Rule

Let’s say you’re a single parent with a monthly take-home pay of $3,500. Here’s how the 80/20 rule might look for you:

- 20% Savings and Debt Repayment: $700

- $400 to pay off credit card debt

- $300 into an emergency fund

- 80% Spending: $2,800

- Rent: $1,200

- Groceries: $400

- Utilities: $200

- Transportation: $300

- Miscellaneous: $700

This setup gives you a clear plan for your money without overcomplicating things.

What if it fails?

It is common to fear failure. Fear can be paralyzing and prevent you from even trying, so let’s make it clear: it is completely ok if the 80/20 budget rule doesn’t work for you – you will learn from it and will have lost nothing from trying this simple budgeting method.

Plus, you can either improve it to make your own, personal budgeting method or choose another method that suits you better. In any case, you will have learnt a bit and got some experience in budgeting – you can only get better!

To make it even easier, check our own take on why budgets fail and how to fix them. I think this will solve the problem! 😉

Final Thoughts: Simplify Your Finances Today

The 80/20 budget rule is perfect for anyone who wants to manage their money without the stress of micromanaging every expense. It’s simple, flexible, and effective, making it a great starting point for beginners—or a refreshing change for seasoned budgeters who want to simplify their approach. Give it a try, and let me know how it works for you! What’s your biggest struggle with budgeting? I’d love to hear from you in the comments. Here’s to making your money work for you—without all the stress!